The gig economy has radically transformed our way of life; everything from moving, traveling, and working is new and different. And, if anything, the current societal reshuffling brought on by the pandemic has made these changes pick up even more speed. The rising sector of online professional services is no stranger to this situation. Therefore, at Bunny Studio, we’ve taken the time to thoroughly analyze things point-by-point through an in-depth study. With these data points, we hope to aid you in your understanding of these interesting shifts.

As part of our study, we’ve established the following.

- What are online professional services? Also, their size, scope, and revenue stream.

- What is their place in the larger gig economy?

- The difference between managed services and open marketplaces.

- The importance of microwork vs online freelancing.

- How big is the segment for online professional services?

- How automation and AI will affect these industries in the future.

What Are Online Professional Services?

We define online professional services as working activities that are provided in a temporary, task-based manner. Also, they happen exclusively through digital intermediaries. We can also segment them as freelancing or microworking.

Some of our main takeaways about this market segment are:

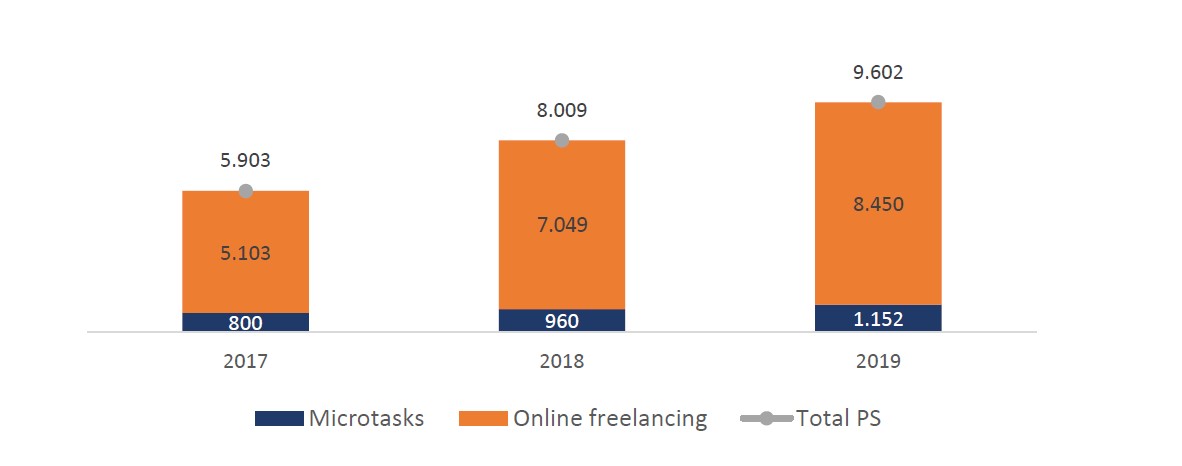

- We estimate that the 2019 global service volume (GSV) of online professional services approached $9.6 billion USD.

- The CAGR for this sector was 27.5% between 2017 and 2019.

- Seven companies hold approximately 80% of the GSV.

- The global demand for freelancers is rising. Mostly, for creative projects, software development, and web development. Most clients are in North America and Europe. But, most of the workforce hails from Southeast Asia.

- Companies are more open than ever to outsourcing. Online professional services are their first bet. Firstly, because there’s a removal of administrative barriers. Secondly, there’s a motivation to reduce costs.

- The number of freelancers is increasing by the minute. Mainly, the motivators are managing one’s own time and work flexibility.

- Expert-oriented platforms are gaining momentum and could be a high revenue segment soon.

- COVID-19 created a huge interest in online work.

Of course, it’s not particularly easy to provide tacking statistics for the gig economy. Mostly, because of the tremendous variation in activities that it can contain. But, in our paper, we’ve found it helpful to segment these activities and focus on one: professional services.

In the realm of online professional services, digital platforms link up clients and freelancers to help complete professional objectives. These sites completely disrupt the traditional employer-employee relationship. Bunny Studio is one such platform in a sea of competitors. Similarly, work that is outside of these platforms is not within the scope of this article.

Managed Services vs Open Markets

Broadly speaking, the business model of online professional services involves the interaction of three key actors:

- Customers;

- A company that provides a digital marketplace where interactions take place;

- A large workforce.

The process of a typical interaction in this business model depends on the role played by the intermediary firm.

On the one hand, open or marketplace firms enable the interaction between customer and worker by letting companies post short-term jobs/gigs. Then, they select the worker better suited for the job based on their reviews, reputation, and interaction with previous employers. Additionally, in this sort of platform, any person can participate as a work provider. In consequence, in this model, the quality of the outcome is not always guaranteed.

On the other hand, managed services firms are more involved in the whole interaction between clients and work providers.

One of the largest differences between the marketplace and managed services models consists in that the latter guarantees the quality of the job-to-be-done. This fulfillment requires, in most cases, vetting participants of the work marketplace. Another requirement is exercising fuller ownership of the delivered services. Thus, quality guarantees become a surefire strategy for success.

Microwork vs Online Freelancing

But that’s not all that there’s to be said about online professional services. Nowadays, aside from a wide market that encompasses many freelancing tasks, there are more subdivisions of labor. Mainly, the deciding factors are the variety, duration, and difficulty of the tasks. Depending on these, we organize work into microwork and online freelancing.

- Microwork or microtasks — frequently last less than an hour, with very low complexity. Examples are tasks like annotating, data transcriptions, and surveys.

- Online freelancing — tasks often take days to months, with low to high complexity. Some examples are design, web development, or social media management.

Microwork tasks are usually uniform in their complexity and duration. Conversely, the complexity of tasks in online freelancing can vary a great deal. Also, variables like remuneration, difficulty required skills, and qualifications differ from task to task.

This gives rise to what we call occupation classes in online freelancing. Some examples are:

- Specialized professional services — professions like accounting, consulting. financial planning, human resources, legal services. project management, and scientific research;

- Clerical and data entry — jobs like data entry, customer service, tech support, transcription, virtual assistant, and web research;

- Creative and multimedia services — jobs such as animation, architecture, audio, logo design, photography, presentations, video acting, video productions, voice over services (dubbing, narrations, etc.);

- Sales and marketing support — ad posting, lead generation, SEO, telemarketing;

- Software development and technology (IT) — data science, game and mobile development, QA and testing, server maintenance, software development, web development, web scraping;

- Writing and translation — academic writing, article writing, copywriting, creative writing, technical writing, translation.

Size of Online Professional Services

It’s hard to gauge the size of online professional services in relation to the gig economy. In our analysis, we took a bottoms-up approach to build an estimate for the existing market. Our metric to measure the market size was the global services revenue (GSR) and the final statements of alternative freelancing companies. However, for some cases, we also use media statements regarding company performance or third-party market estimations based on recent valuations in addition to internal company information for Bunny Studio.

Given our estimation, the size of the market was close to $10.8 billion USD in 2019. We also estimated that the online outsourcing segment was about 90% of this value. In terms of growth, our estimates showed that professional services had a CAGR of 27.5% in the last three years and that the online freelancing segment increased its volume at a rate close to 29%.

80% of the GSV of professional services in 2019 went through the platforms of seven companies. At that point, the market leader had more than $2 billion USD in transactions that represented a fifth of the whole volume. From this figure is also evident that online outsourcing companies held most of the value of the professional services and that those that offer IT and specialized services (particularly, consulting) had a high GSV.

Demand and the Pandemic

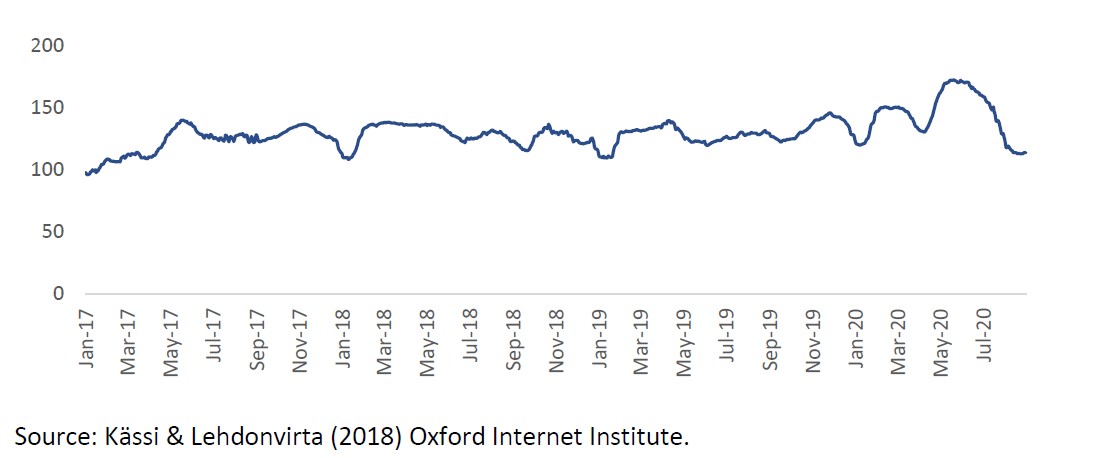

Moreover, the last three years saw a net increase in demand for online professional services. As seen before, in the last three years the market for online professional services has increased its volume at an average rate of close to 27%. According to the Oxford Internet Institute Online Labour Index12 (OLI), job postings for online freelancing increased around 40% between January 2017 and December 2019.

However, as seen in the following figure the number of projects and tasks has seen an abrupt decline since April 2020, probably as a consequence of the COVID-19 pandemic. On the other hand, these numbers seem to be rebounding and showing signs of overall economic recovery.

The demand for professional services is made up of mostly software and creative projects. Especially, job openings for software and development jobs had nearly doubled before the pandemic. While creative services had grown at a slower rate, they were still increasing steadily.

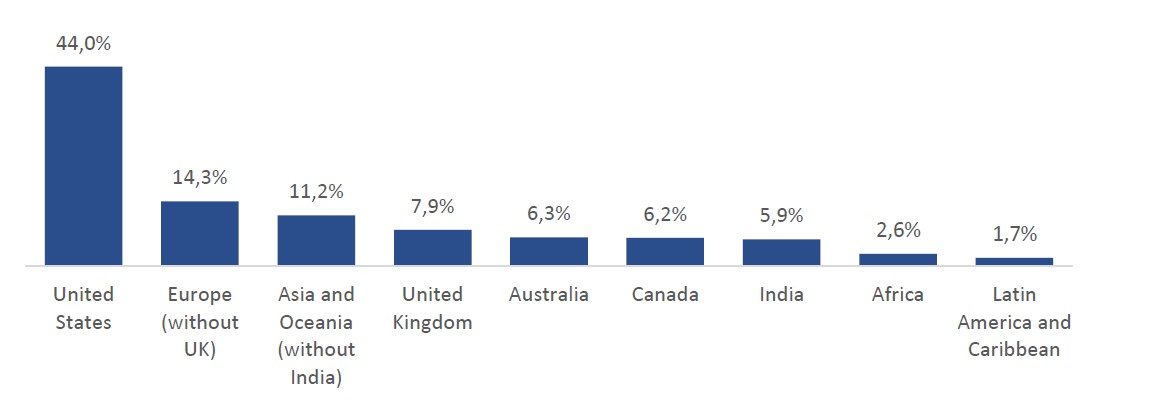

Also, most clients of professional services are in the US or Europe. The US, Canada, continental Europe, and the United Kingdom opened 72% of the online professional services postings in platforms monitored by the OLI in 2019. Only 17% of the global demand was originated in Asia, where India alone claimed a third of the region’s share.

Mass Adoption of Freelancing

Furthermore, evidence shows that companies are more and more open to the idea of employing online freelancers. As shown in a survey conducted by SIA (2018) with North American companies, the proportion of companies currently using online platforms or considering using them in the short term to hire personnel increased from 4% in 2012 to 44% in 2017.

What has justified this mass adoption of freelancing? Mainly, it seems to be that flexibility, removing barriers, and cost reduction seem to be the causes. Also, it helps companies and organizations reach operational levels that are unsustainable with traditional staffing, or during high-demand periods.

Our methodology also shows that the overall number of freelancers is rising. By surveying all online professional services platforms, we’ve found a number close to 70 million. Even lacking a uniform methodology for estimating the freelance workforce, the evidence suggests sustained overall growth.

What are the main motivators? It seems that freelancers—who are relatively young and living in Asia or the US—favor flexibility and greater control of their own time. These factors probably help account for the higher amount of highly skilled workers showing up online in droves. More and more, we tend to associate freelancing with non-seasonal and full-time work. This also explains the enormous disruptive effects of online professional services.

It seems that even with the downtick caused by the COVID-19 pandemic, the tendency is for things to be on the rise. In the aftermath, it seems that both the overall supply and demand for online services are only going to rise.

AI and Automation: The Future of Online Professional Services?

Progress in automation and AI is a complex issue. While it can create jobs, it can also lead to the erosion of established professions. Research on automation shows that “engineering bottlenecks” are the main determinant of whether an occupation can be replaced or not. In short, this means that, depending on technological progress, some professions are “more replaceable” than others.

But what are these engineering bottlenecks? Mainly, they refer to AI’s ability to replace the part of human cognition that can efficiently do a certain task. This determines whether AI can effectively disrupt certain professions, while not being a threat to others — yet.

What are the main features of human intelligence that AI has trouble with?

- Social intelligence;

- Creative intelligence;

- Perception and manipulation in unstructured environments.

Low and medium-skill occupations like clerical work, sales, and writing are the gig economy occupations more endangered in the short term. Of course, by this, we mean the lower end of these professions, such as transcriptions, basic translations, sales calls (already being parsed out by complex AI scripts), etc. For instance, while there are many AI translation systems readily available, most of their work still requires the input, correction, and editing of a capable human translator. Conversely, creative writers, are not at risk of replacement anytime soon.

However, data entry and annotation services like AMT are necessary for AI to work properly and thus are not believed to be replaced. But what are, by our estimation, the professions and niches with the highest probability for replacement?

Let’s take a look; the more a value approaches 1, the highest the likelihood of replacement by AI:

Clerical and Data Entry

- Paralegals and legal assistants 0.94

- Medical transcriptionists 0.89

- Telephone operators 0.97

- Bookkeeping; accounting; and Auditing Clerks 0.98

- Office clerks; general 0.96

Creative and Multimedia

- Multimedia artists and animators 0.02

- Commercial and industrial designers 0.04

- Graphic designers 0.08

- Interior designers 0.02

- Music directors and composers 0.02

- Radio and television announcers 0.10

Professional Services

- Accountants and auditors 0.94

- Budget analysts 0.94

- Financial specialists; all other 0.33

- Engineers; all other 0.01

- Physicists 0.10

- Chemists 0.10

- Lawyers 0.04

- Judicial law clerks 0.41

Sales and Marketing Support

- Sales representatives; wholesale and manufacturing, except technical and scientific products 0.85

- Telemarketers 0.99

Software and Technology

- Computer systems analysts 0.01

- Software developers; applications 0.04

- Software developers; system software 0.13

- Database administrators 0.03

- Computer support specialists 0.65

- Computer occupations; all other 0.22

Writing and Translation

- Technical writers 0.89

- Translation and interpretation 0.38

Final Remarks

Technological breakthroughs in the mid-term related to creative content generation could displace some of the demand for creative services. Still, it seems that the gig economy and online professional services continue to be poised to disrupt the future of work.

And, with a bright future of growth ahead, Bunny Studio expects to continue to lead the way in providing first-rate creative services!